But should artificial intelligence have a say in your wealth?

When you purchase through links on our site, we may earn an affiliate commission.Heres how it works.

All being used to help grow your money in a more straightforward and easy way.

Sure, the idea of having a financial planner in your pocket sounds nice.

The same goes for our financial wellbeing.

Wally

The personal finance app helps you track your spending, savings, and overall financial wellness.

How have my expenses changed over the past four months?

How much do I need to save each month for a week-long trip to Greece?

It can also explain financial terms and trends and give recommended investment advice.

SoFi’s Robo-Advisor

The app promises to “help you do less guessing and more investing.”

It will automatically give everything an adjustment every quarter, too.

AI services come sans stigma, which can make it easier to seek out advice.

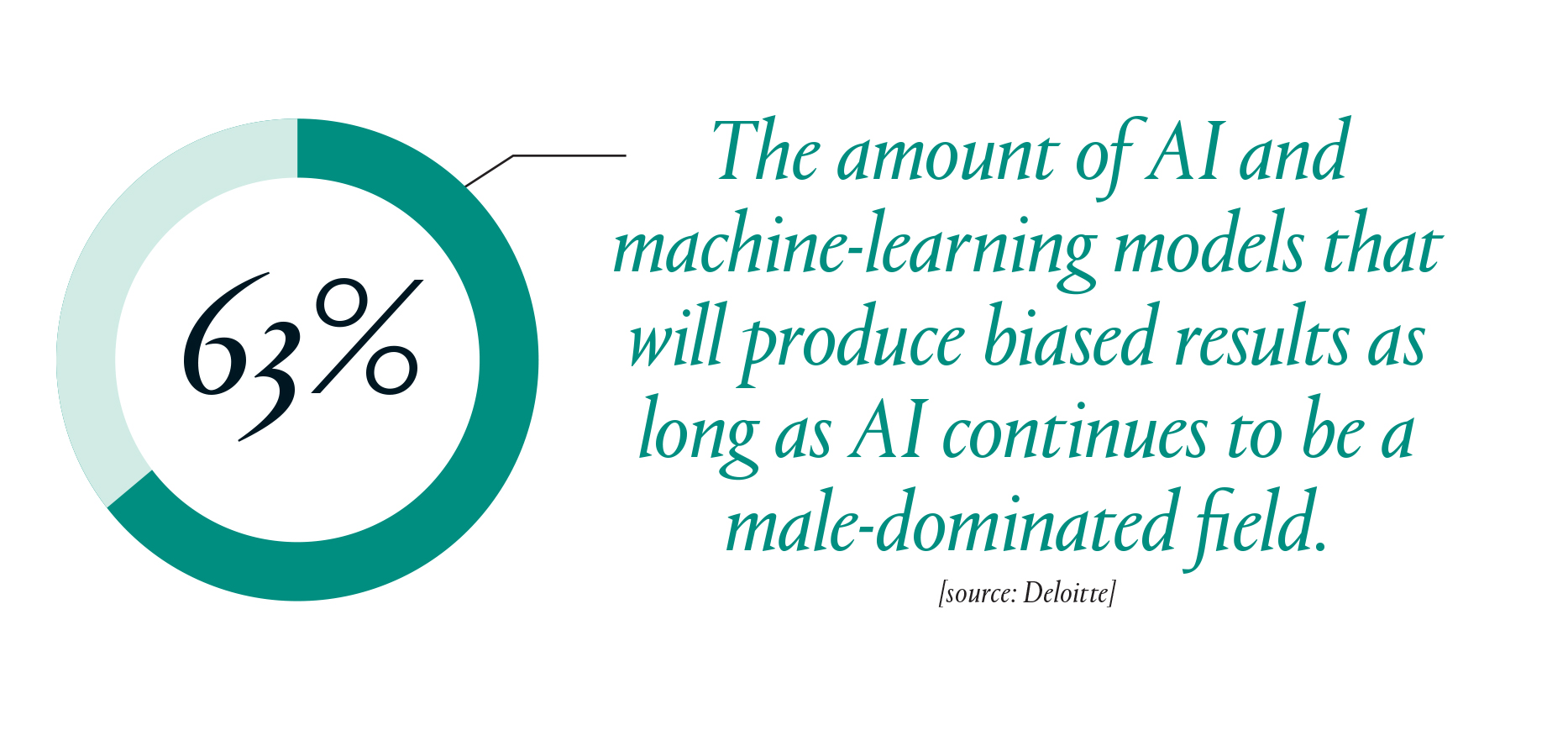

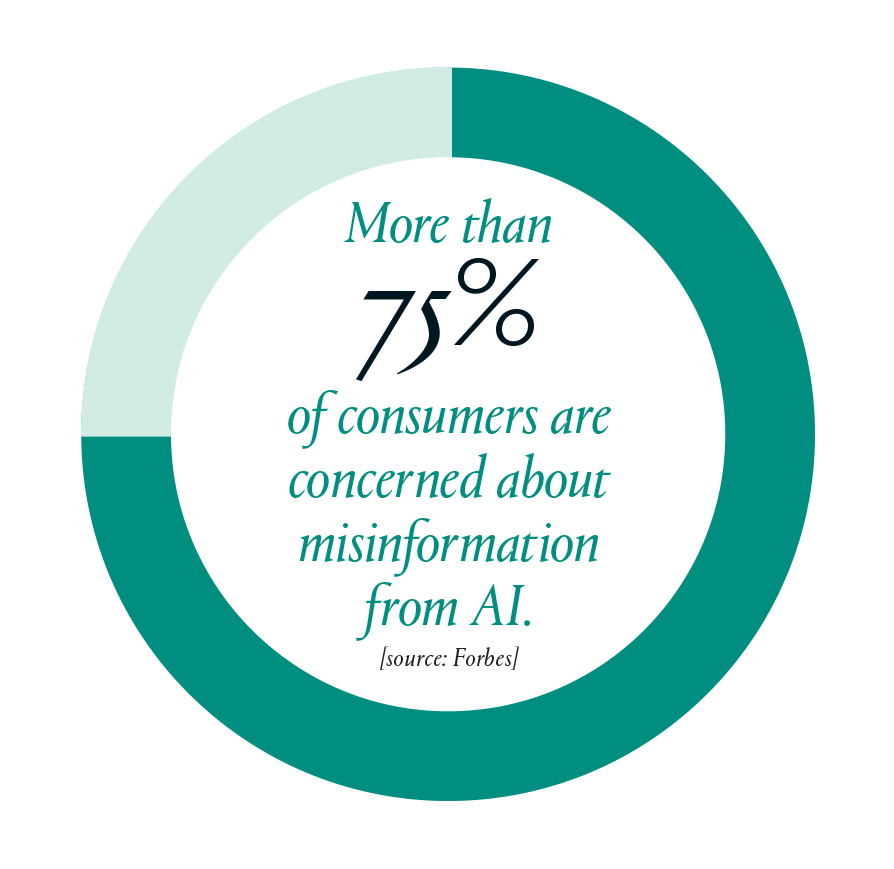

Those very same algorithms are responsible for telling those very same people how to invest their money.

Robots aren’t sad about losing your money

AI is not a fiduciary.

That means it’s not obligated to act in your best interest.

Wait, what exactly is a robo-advisor?

Technically, it’s not a robot at all.

It’s technology that provides automated financial information and guidance.

If you’ve ever chatted with customer service “bots” online, it’s a similar experience.

Different services offer different things.

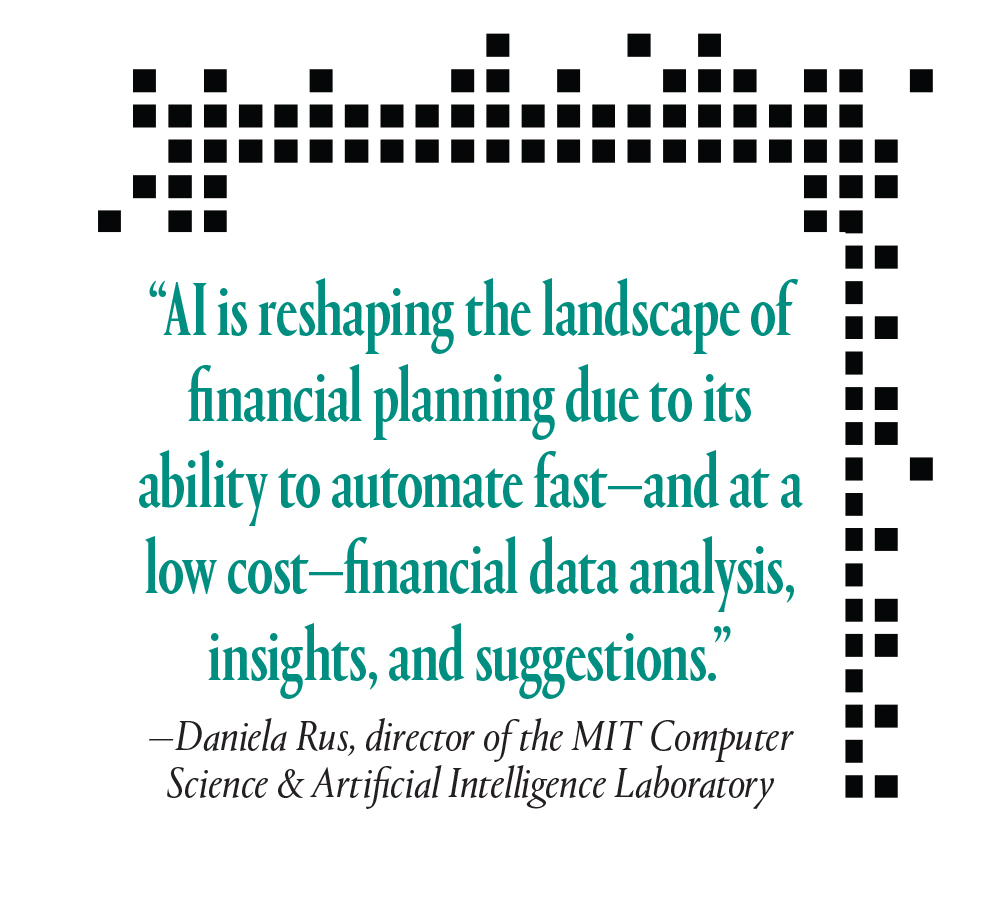

What would perhaps take you hoursdays!to calculate, takes the algorithm mere seconds.

AI lacks the human touch, emotional intelligence, and ethical considerations for financial planning.

Professor Cynthia Rudin

“No, we don’t believe human advice will ever go away.

In an interview about her real estate career?

Denim shorts on deck.

The Prince and Princess of Wales will mark their 14th anniversary on April 29.